Rate Service and Calculators

Discover Home Loans

The home loan industry has recently undergone some radical changes, so Discover Home Loans wants to keep their process simple and stress-free for their customers.

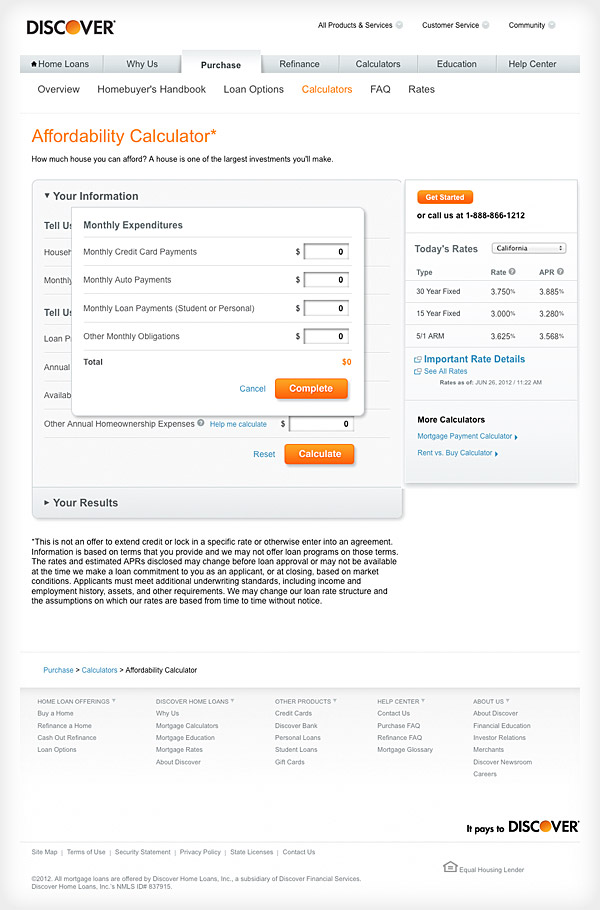

We collaborated with them to streamline how they distribute their geo-dispersed interest rates and disclosures. Using our Interest Rate and Disclosure Manager service we insured rates and disclosures are always available, and that they experience low latency across the globe.

Our software as a service (SaaS) product allows Discover Home Loans to achieve compliance, and earn consumer confidence. Each digital touchpoint for Discover Home Loans uses this service, which ensures that rates and disclosures are always displayed quickly and accurately—even when they change multiple times a day.

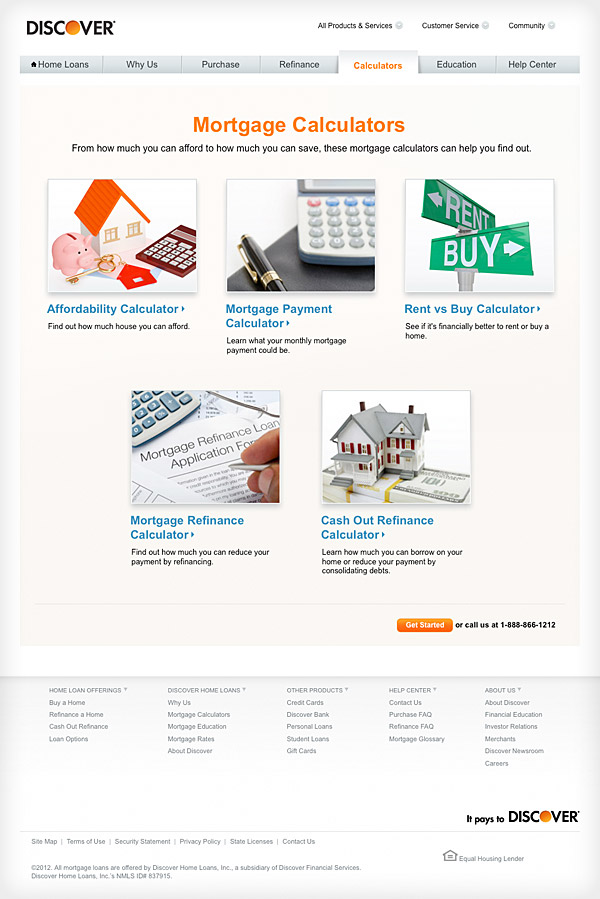

Finally, Fusebox created six easy-to-use personal finance calculator tools for Discover Home Loans to help consumers gauge how much they can afford before making the leap to apply for a home loan.

Discover Financial Services has partnered with Fusebox on a wide range of digital initiatives.

We collaborate closely with each of their key business units—including Discover Bank, Discover Student Loans, and Discover Home Loans and their partners—on strategic planning, creative projects, and technology implementations. We apply effective project management principles—working as an extension of the Discover team—to create short- and long-term project road maps.

Together, we have developed a number of valuable initiatives and powerful service offerings that continue to provide significant return on investment. Site design, mobile, email management and deployment integration, online marketing campaigns, applications, and our Interest Rate and Disclosure Manager, an SaaS which allows consumer banks to manage the interest rates and disclosures of various products with a single live service.

We take a 360-degree approach to everything we do. It's the way we like to work—and the way we work best.